SSA SSA-721 2008-2025 free printable template

Show details

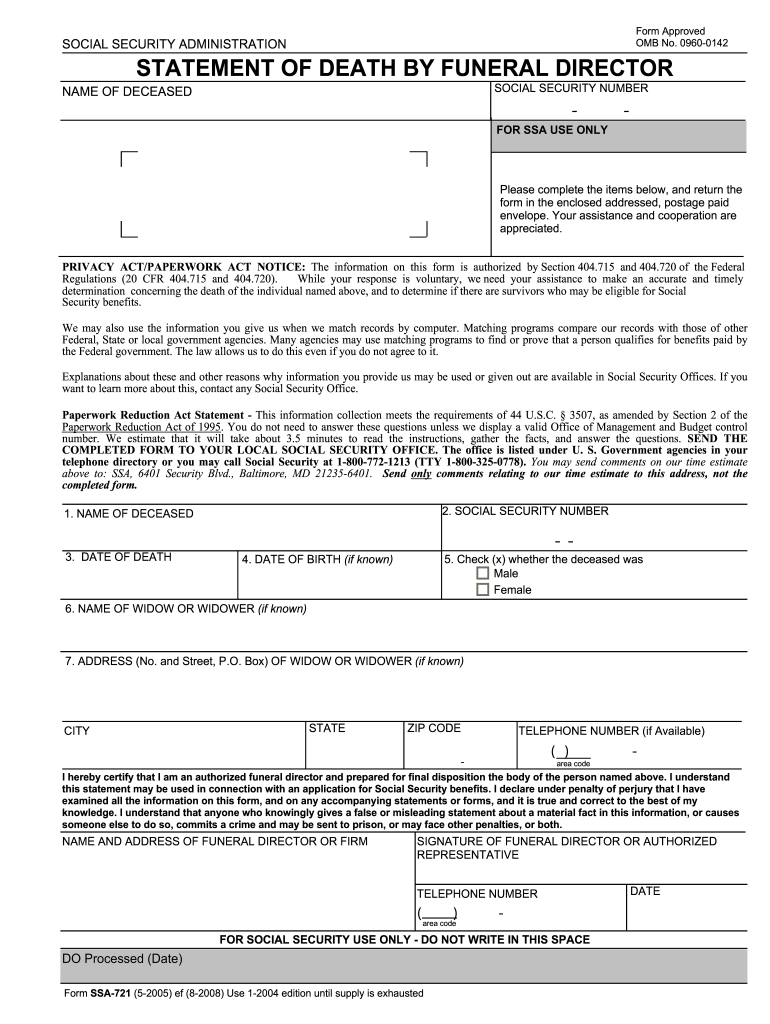

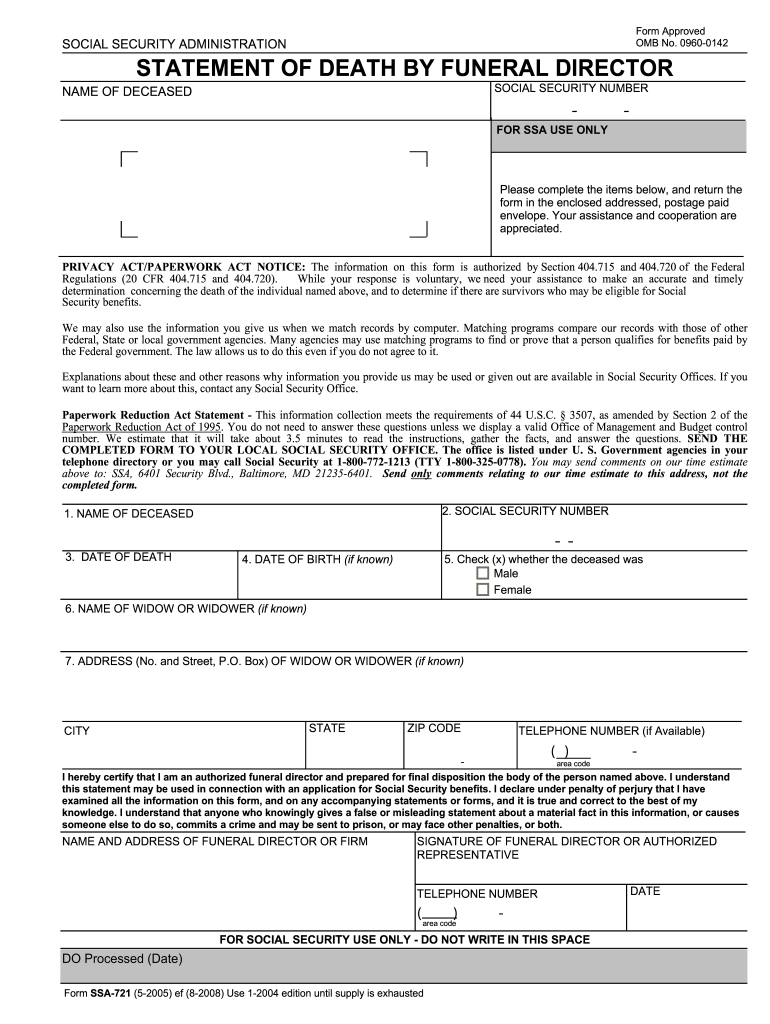

NAME AND ADDRESS OF FUNERAL DIRECTOR OR FIRM SIGNATURE OF FUNERAL DIRECTOR OR AUTHORIZED REPRESENTATIVE FOR SOCIAL SECURITY USE ONLY - DO NOT WRITE IN THIS SPACE DO Processed Date Form SSA-721 5-2005 ef 8-2008 Use 1-2004 edition until supply is exhausted DATE A MESSAGE FROM SOCIAL SECURITY Your funeral director is helping the Social Security office by giving you this information about Social Security benefits. Form Approved OMB No. 0960-0142 SOCIAL SECURITY ADMINISTRATION STATEMENT OF DEATH...

pdfFiller is not affiliated with any government organization

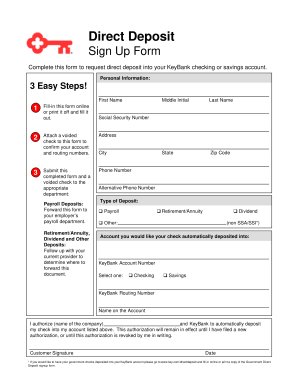

Get, Create, Make and Sign ssa 721 form

Edit your pdffiller form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form ssa 721 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ssa 721 fillable form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ssa form 721 pdf. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SSA SSA-721 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ssa 721 statement of death by funeral director form

How to fill out SSA SSA-721

01

Obtain a copy of SSA Form SSA-721 from the Social Security Administration website or your local Social Security office.

02

Fill in the first section with the deceased worker's information, including their name, Social Security number, and date of death.

03

Complete the second section with your information, including your name, relationship to the deceased, and your address.

04

In the third section, indicate if you are claiming benefits for yourself or on behalf of another claimant.

05

Sign and date the form, confirming that the information provided is accurate.

06

Submit the completed form to the Social Security Administration by mail or in person.

Who needs SSA SSA-721?

01

The SSA SSA-721 form is needed by individuals who are applying for Social Security benefits on behalf of a deceased worker.

02

It is often used by family members or representatives who are fulfilling the legal obligations of reporting a worker's death to the Social Security Administration.

Fill

ssa 721 form pdf

: Try Risk Free

People Also Ask about ssa 721 pdf

How do I apply for $250 Social Security death benefit?

You can apply for benefits by calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or by visiting your local Social Security office. An appointment is not required, but if you call ahead and schedule one, it may reduce the time you spend waiting to apply.

What form does Social Security death beneficiary use?

The IRS Form SSA-1724-F4 is used by the relatives of the deceased social security recipient or the legal representative of the estate. Among the immediate relatives allowed to receive these payments are the spouse, children, and parents of the deceased.

Who is eligible for the $250 death benefit from Social Security?

A one-time lump-sum death payment of $255 can be paid to the surviving spouse if they were living with the deceased. If living apart and they were receiving certain Social Security benefits on the deceased's record, they may be eligible for the lump-sum death payment.

What form do I need for last Social Security payment after death?

Form SSA-1724 | Claim For Amounts Due In The Case Of Deceased Beneficiary. A deceased beneficiary may have been due a Social Security payment and/or a Medicare Premium refund prior to or at the time of death.

What happens if you don't report a death to Social Security?

There is no prorating of a final benefit for the month of death. If Social Security pays the deceased's benefit for that month because it was not notified of the death in time, the survivors or representative payee will have to return the money.

When can I apply for Social Security death benefits?

The earliest a widow or widower can start receiving Social Security survivors benefits based on age will remain at age 60. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ssa721 for eSignature?

Once your social security form ssa 721 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I edit 721 social form on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing form ssa 721 blank right away.

Can I edit form ssa 721 funeral home on an Android device?

You can edit, sign, and distribute statement of death by funeral director on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is SSA SSA-721?

SSA SSA-721 is a form used to report the death of a wage earner to the Social Security Administration (SSA). It is primarily used to provide necessary information about the deceased individual for processing survivor benefits.

Who is required to file SSA SSA-721?

The SSA SSA-721 is typically filed by a family member or an individual who is entitled to benefits based on the deceased wage earner's work record. This includes surviving spouses and children.

How to fill out SSA SSA-721?

To fill out SSA SSA-721, you will need to provide the deceased individual's name, Social Security number, and date of death, along with your own contact information and relationship to the deceased. Follow the instructions on the form for additional details.

What is the purpose of SSA SSA-721?

The purpose of SSA SSA-721 is to formally notify the SSA of an individual's death, which is crucial for stopping dependency benefit payments and processing any survivor benefits that may be available to eligible family members.

What information must be reported on SSA SSA-721?

The information that must be reported on SSA SSA-721 includes the deceased person's full name, Social Security number, date of death, the relationship of the reporter to the deceased, and any relevant details that the SSA may require for claims processing.

Fill out your SSA SSA-721 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ssa Form 721 is not the form you're looking for?Search for another form here.

Keywords relevant to 721 form

Related to ssa 721 statement of death form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.